Last Updated on July 24, 2022 by The MediFi Guy

The Four Horsemen of your Financial Apocalypse:

The financial advisor

The car salesman

The private banker

The insurance broker

The Financial Advisor

“What’s wrong with having a financial advisor? Shouldn’t I get an expert to help with all this confusing financial stuff? I mean if you can’t do something yourself, you hire an expert to do it for you, right?”

The reasons you should carefully consider whether the services of a financial advisor are in your best interest before signing up with one can be summarised as follows:

1) Everything a financial advisor knows and does, you can easily learn to do yourself. Do not be fazed by the jargon, it will all make sense in time.

2) The vast majority of Financial advisors are incentivized to sell you financial instruments that generate the highest commissions for themselves, regardless of whether the said instrument is appropriate for you – e.g. whole life insurance which many will try their best to push on you at all costs, for the sole reason that selling it to you generates high commissions for themselves.

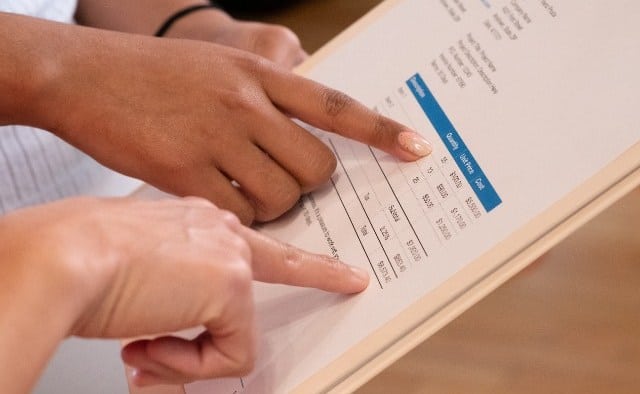

3) The fees charged by financial advisors, while they may seem small (eg, “1% of assets under management”), can over time shave off as much as 40% of your final investment amount at retirement. Meaning after decades an investment that would have totaled R 1 million without a financial advisor managing it can be reduced to R 600 000 because of a small 1% fee added on top of other fees. All for or doing things which you could have easily done yourself and kept the R400 000.

4) You are guaranteed to lose money on your investments if you have a financial advisor. We now have about 4 decades of data that shows that investments actively managed by financial advisors cannot consistently outperform the market. 80-90% of actively managed funds fail to outperform the market after fees. You are far better off investing in a passively managed index tracking fund wherein you’re guaranteed to get the average return of the market, than in an actively managed fund wherein you’re guaranteed to lose the amount in fees you have to pay to the financial advisor first, after which you have to regain that loss to break even and hope to beat the market. And since the vast majority of active funds fail to do so consistently, even if you manage to beat the market a few times, over the entire lifetime of your investment it will underperform thereby overall nullifying those gains.

Legal Disclaimer: The information on this website including research, opinions or other content is not intended to and does not constitute financial, accounting, tax, legal, investment, consulting or other professional advice or services. The author of this blog does not act or purport to act in any way as a financial advisor or in a fiduciary capacity. Prior to making any decision or taking any action, which might affect your personal finances or business, you should take appropriate advice from a suitably qualified professional or financial adviser.